Financing for business. Faster than ever

PragmaCash is a modern funding solution for SMEs, offering:

PragmaGO is the provider of the PragmaCash service.

Łatwiejsze zakupy, zadowoleni klienci

i większa sprzedaż

| As our Partner, you will get: |

| Clear advantage over competition – be the first to use such a solution countrywide |

| Loyalty increase – 94% of companies declare that they’ll use the loan once more. |

| Full service – say the word, and we’ll implement PragmaCash within your environment in a matter of days. |

| A personal touch – our solutions enhanced with your brand’s identity and personalized forms. |

| Scalability – our goal is to build scale together with our partners. |

| Your merchants will get: |

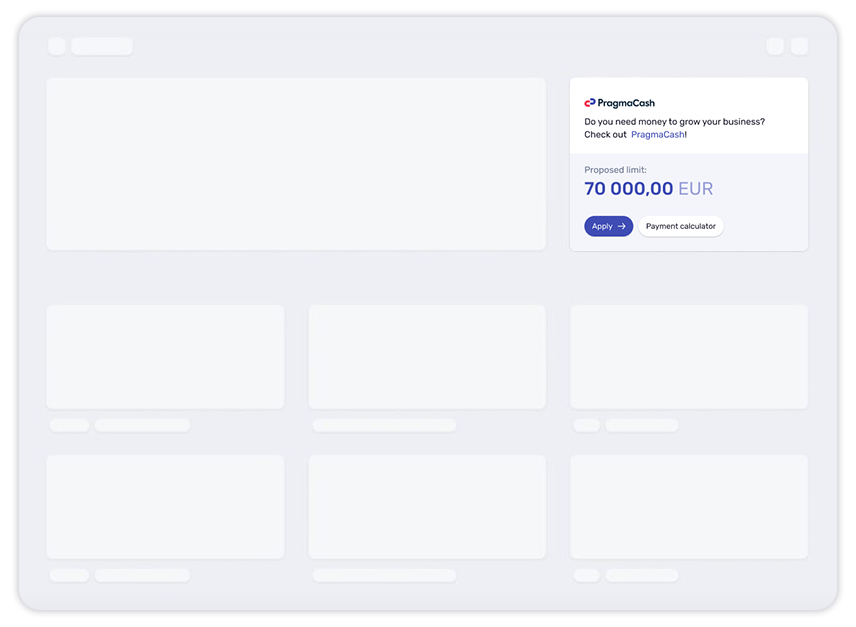

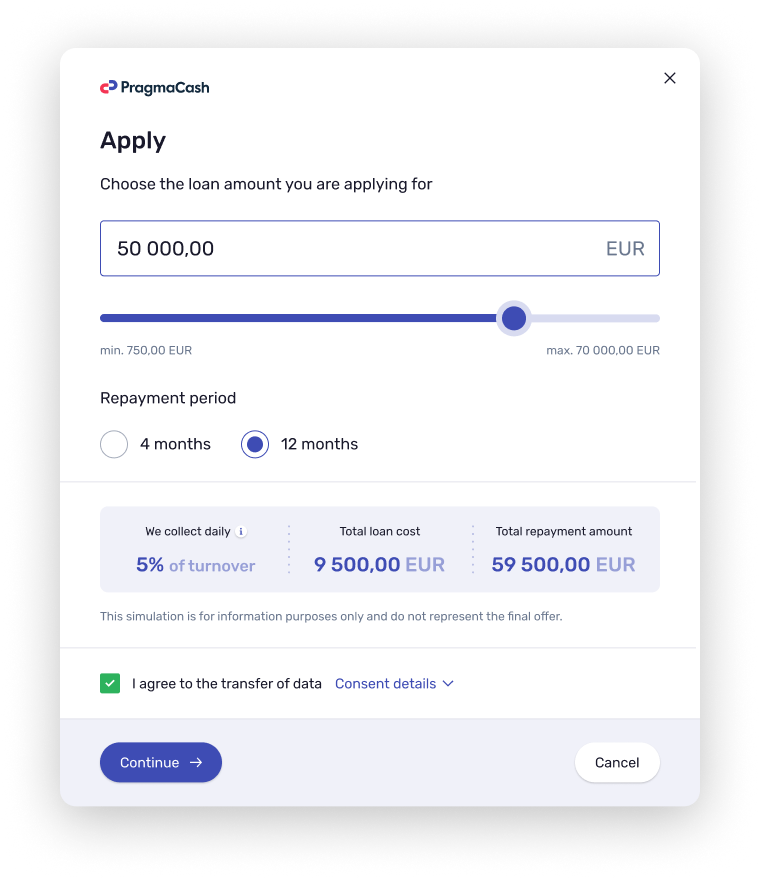

| Up to 70,000 EURO – for any company purpose, transferred directly to their account! |

| Clear costs – fixed interest rate, all loan costs stated in the agreement, no hidden fees. |

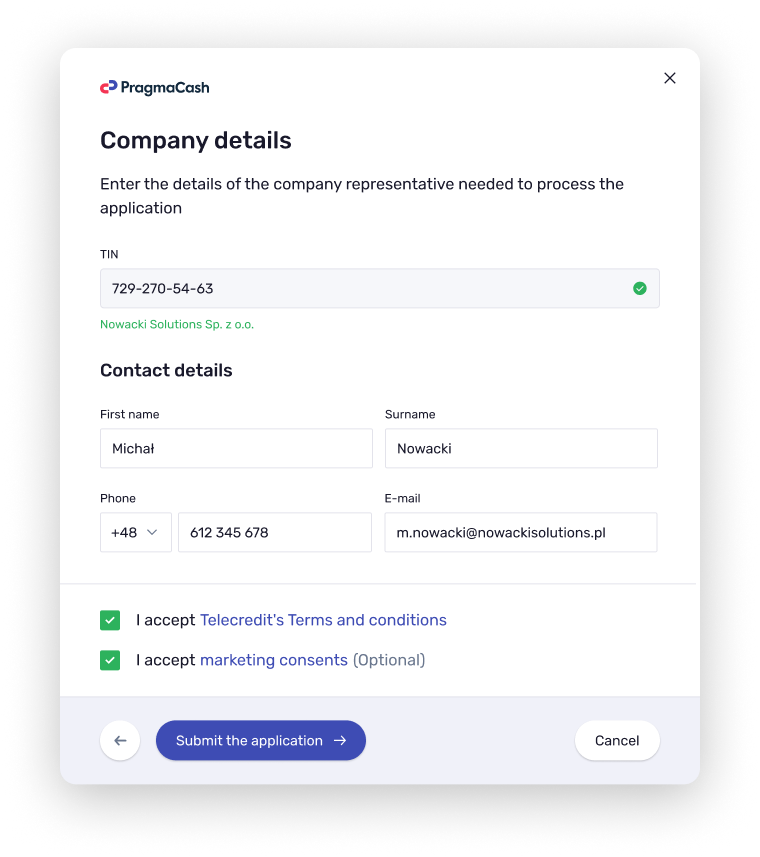

| Quick execution – fast decision and financing available within one business day. |

| Pre-approved limit – based on merchant’s turnover. |

| Time-saving solution – 100% digital, process with no additional company docs and no actual paperwork. |

Trusted and validated solution

>0%

approval rate

0K

customers with pre-approved limits

EUR0K

average funding value

PragmaCash is that simple

Why partner with us?

We are PragmaGO, and we’re here to deliver much needed financial solutions for companies – just like we already did for partners, such as Allegro, Polskie ePłatności and Przelewy24 (Nexi Group). We are ready to provide financing in a world where businesses expect flexibility, security and accessibility at all times.

We offer modern and flexible REST API with thorough documentation. It means we’ll implement our solutions to your environment quickly and seamlessly.

We provide pre-built components, ready to include into your environment: loan application front-end, contract signing, decision-making processes, and more.

We are honored to receive The Best Embedded SME Lending Solution in the CEE award for our products and we are committed to continue innovating in the years to come.

We are ready to scale – we guarantee high uptime (99.9% SLA), we are capable of processing up to 10,000 applications a day, and we can adapt to various business models, including RBF, MCA and BNPL.

We prioritize security with multi-layer encryption and ongoing risk monitoring (24/7, with dedicated technical support). We are also fully GDPR, PSD2 and NIS2 compliant.

Media

Lets’ talk business

Type in your contact details – let’s get in touch and start working together!